Theft Cases Continue to Rise

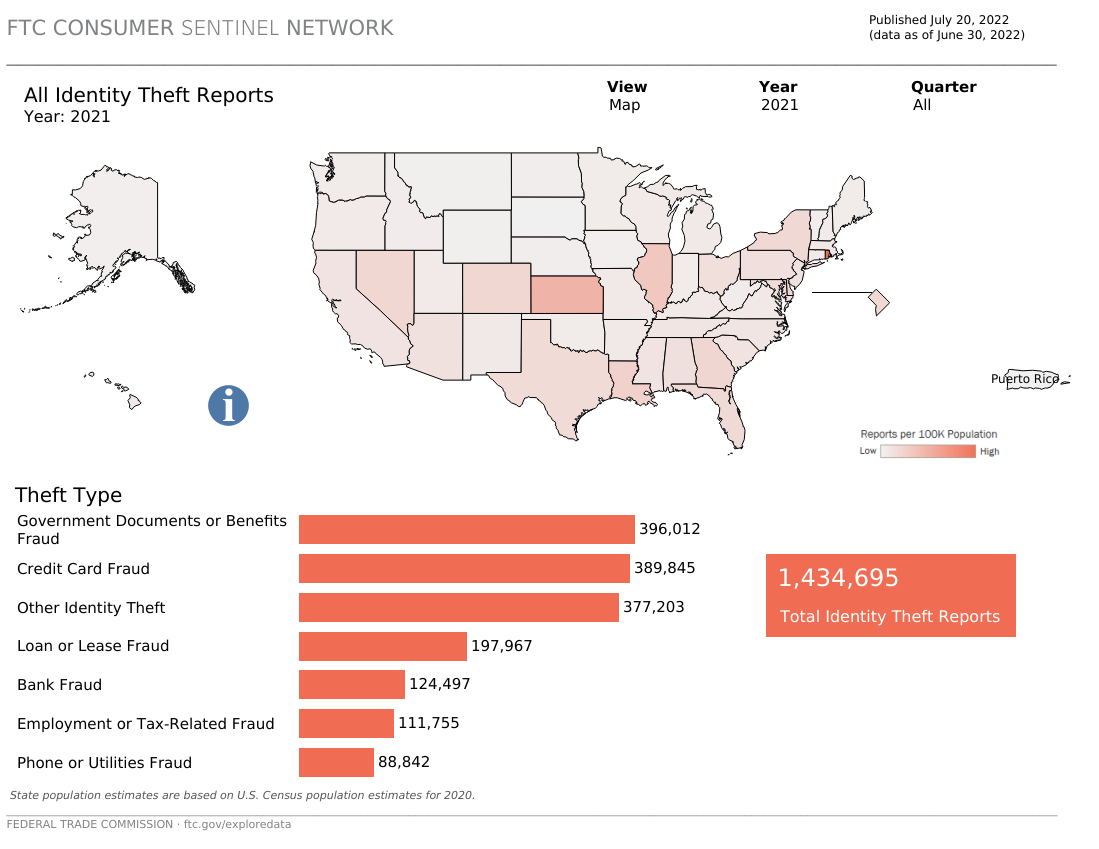

Identity theft cases are on the rise. Again. Year after year cases continue to skyrocket and are not predicted to decrease anytime soon. The ID Theft Center reported that fraud and scam reports in 2021 reached higher levels than any previous year since they began collecting the data back in 1999. According to a map created by the Federal Trade Commission Identity Theft Reports in 2021 reached an intimidating total of 1,434,695 for US Citizens.

Which brings us to the question, why is this type of theft so prevalent? To fully understand the abominable mind of the criminal, we will take a deep dive into the methods used for thievery against unsuspecting citizens and businesses alike. Then we will examine the ways in which they use stolen identity to their benefit.

How do fraudsters steal your information in the first place?

Fraudsters are after your Personal Identifying Information (PII), such as social security number, name, address, DOB, driver’s license number and more. These can be used by the thief to commit a variety of different types of crime. Unfortunately, there are numerous ways in which PII can be stolen. While we may live in a digital age, the methods used by thieves to steal identities can often be more reliant on tried and true “analog” methods such as:

- Stealing wallets or purses – A wallet or purse may contain multiple forms of ID including Driver’s License, Credit Cards, Healthcare information and more. In the hands of fraudsters, this information can be taken to make illegal purchases or open fraudulent bank accounts. In the case of a stolen wallet or purse, it is critical that you report the theft to your local police department and the DMV. Then you should set a freeze on all your bank accounts. To further protect yourself, avoid carrying unnecessary PII (such as your social security card) around on a regular basis.

- Going through mail – criminals may go through your mail in search of documents that contain your PII. These include, but are not limited to, bank statements, medical records, checks, and more. Criminals can combine the PII found across multiple documents together to commit crimes. It is recommended that anything you mail with sensitive information is given directly to your mail carrier or the post office. Furthermore, any mail that you dispose of with sensitive information should first be shredded.

More frequently, identity thieves have utilized cyber methods to obtain valuable PII data such as:

- Public Wi-Fi – While public Wi-Fi can be convenient and free, it poses great risks as well. Cybercriminals can use vulnerable public Wi-Fi networks to steal your information. Often, the data is not encrypted while using a public Wi-Fi connection, leaving your valuable information susceptible. When using public Wi-Fi try to only visit sites with a secure connection (HTTPS). For further protection, consider investing in a VPN if you regularly use public Wi-Fi or hotspots

- Unsecured Websites – Unsecured Websites (HTTP) pose a threat to the user on the site. Best practice is to never give any of your PII or make a purchase on an unsecured site. A secure website will be clearly marked as HTTPS. Unsecured websites may not be malicious in and of themselves, but their lack of security leaves them especially vulnerable to hacks and data leaks.

- Data Leaks & Breaches – Data breaches are unfortunately becoming increasingly more common. Information is Beautiful has a powerful graphic showing some of the biggest data leaks over the years. Regardless of how well you protect your PII in other areas, leaks and breaches by criminals can lead to your information being stolen and used for nefarious purposes. When you are notified that a data leak has occurred it is best practice to update passwords/login credentials and enable Multi-Factor Authentication if possible.

What motivates identity thieves?

Criminals may have multiple motivations for stealing someone else’s identity. While some may use another’s identity to cover up a crime they already committed, others may steal the info for personal reasons. However, it is much more likely that they are driven by the financial incentive - as the stolen PII can give them ways to commit various types of lucrative financial crimes.

What do identity thieves do with your PII?

There are several ways in which an identity thief can use your PII. Below are just a few examples of crimes they might commit:

- Synthetic ID Fraud – Fraudsters can use some of your PII combined with fake information to open a false account at a bank. From there, they can continue to grow their credit with the bank until they eventually are able to take a big cash out and “bounce” - that is, abandon the identity. Read our article on Synthetic Identity Fraud to learn more.

- Government Benefits Fraud – Criminals can use your stolen data to apply for government aid. This was widely seen during the COVID-19 crisis in which criminals used illicitly obtained information to apply for unemployment benefits and more. In some cases, it has been discovered after the fact that benefits were going to overseas individuals, and even to prisoners locked up in the US.

- Credit Card Fraud – Identity thieves may use the information obtained to make purchases with your credit card online. More advanced criminals may be able to use the details to create a fake credit card which can then be used to make in person purchases. Another problem might arise if the bad guys were able to gain login information to your bank account, because then they may even be able arrange to have a new credit card sent to a different address.

The toll of identity theft

For an individual victim, ID theft can result in lasting financial, emotional, and physical costs. It can sometimes take months to resolve credit and financial issues that arise when someone has made fraudulent use of a stolen identity. In some unfortunate cases, finances lost due to the theft cannot be recovered. The stress induced by such an instance can lead to emotional and physical exhaustion and may affect the individual even after the situation has been resolved.

Even Children are frequently targeted by identity thieves. In fact, in many cases, a child’s identity is the ideal target for the professional identity thief looking to build a synthetic identity, because a child’s PII profile is a blank slate - they have yet to take out loans or open a credit card and are therefore less likely to be flagged as fraudulent when being used to open a new account. Also, any fraud committed on a child’s identity is unlikely to be discovered for years – perhaps not until they themselves apply for school loans or a credit card in early adulthood. Often the thief is someone the victim knows personally. However, with the increase in online and social media usage, virtual thieves are becoming more common as well.

Businesses do not get off scot-free either – financial institutions, rental agencies, retailers, online businesses, and other organizations are increasingly feeling the effects of identity fraud. Criminals can open fraudulent bank accounts or use stolen credit card information to make illicit purchases. These actions can result in significant financial losses for the business and potentially severely damage the trust from the company’s consumer base.

.png?width=1640&name=Identity%20Authentication%20Graphic%20(1).png)

Luckily, introducing Know-Your-Customer authentication steps into your business’ processes can greatly reduce the risk of fraud. Such identity authentication practices could include using a secure and fast solution such as PALIDIN, which can quickly authenticate the identity document of your consumer no matter where they are.

Subscribe for updates

-

"PALIDIN is a great product that's simple, elegant, and fast! Our entire staff finds it incredibly easy to use with no difficulties at all. The training was excellent, and now everyone at Midland Honda is confidently using it with every customer. It's been a game-changer for us in preventing criminals from using false identities when purchasing vehicles."

Midland Honda

-

"Great software for identity detection and fraud prevention. Their support team is very attentive! What I like best about PALIDIN: 1) Ease of use 2) Accuracy 3) Customer support 4) Pricing"

Mercedes-Benz Financial Services

-

"PALIDIN gives confidence in every customer transaction. My favorite feature of PALIDIN is its simplistic UX, which allows our frontline staff to be trained quickly and effectively on its processes and utilization. There is nothing I dislike about PALIDIN. PALIDIN allows us to quickly verify critical client identification for purchases exceeding $500,000."

Aston Martin & Bentley

-

"With the technology of fake IDs getting better, you need to have an up-to-date solution. So far PALIDIN has worked very well with no problems and FraudFighter’s support team has been great to deal with. PALIDIN was so easy to setup that the dealership got it up and running in no time."

Eisenhauer’s York Harley-Davidson

-

“The Fraud Fighter ID scanner just saved us a $22,000 loss. We had a bad feeling about this guy so we scanned his Driver's License and it was fraudulent. That made it very easy to tell him we wouldn’t take his credit card or do the sale. When our guard followed him out of the store to catch his license plate he decided to run across the major 6-lane road to get away.“

Coffin & Trout Fine Jewellers

-

“On the first day PALIDIN was implemented, a suspect attempting to withdraw $3,000 from a Shared Branching member account - and also trying to initiate a new HELOC loan application in the amount of $43,000 - was foiled when the authentication of his state-issued driver’s license came back as “failed”. $46,000 of potential loss prevented on the first day of use!!”

People’s Alliance Federal Credit Union

Leave a Comment